All 96 Cent Currencies go to a Dollar

|

Looking at the FX screen today you have to conclude: The dollar is weak. Oh the pain. How many big names have stuck their heads out and said that the strong dollar bet was the trade of the year.

It is tempting to look at this and conclude:

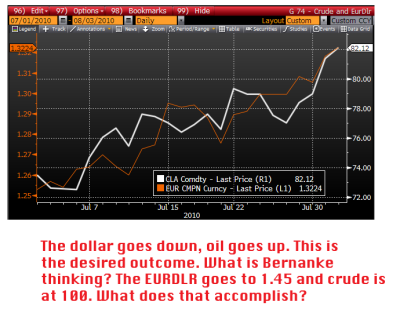

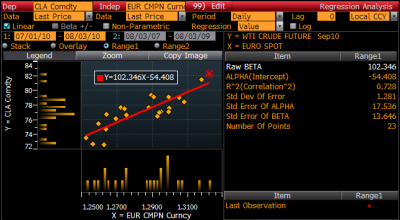

Alternatively it is quite possible that the issues facing the US will overwhelm sentiment and position taking. That would be my best guess for the month of August. Being short Euros might look compelling, but it is a risky trade.The market is not positioned for that reality What might the factors be that influence the outcome? There is not going to be a crisis in the EU for the next 2-3 months. They have a lid on things. A crisis could evolve in Europe if the bond markets unravel (again). If spreads widen and CDS is again a topic in the papers then the dollar would be in demand. But that is unlikely to happen with the EU defense mechanisms in place. They have mega billions available to buy bonds. They have been able to contain the crisis with a modest amount of intervention. Shorting Spanish bonds is no longer a sure winner. There is a big carry cost to being short. There is two-way risk. The world is “short” yield today. There seems to be a limitless demand for fixed income paper. This will pass at some point. But not for the foreseeable future. There is a slow motion crisis evolving for the dollar in my view. There is a lack of viable options for the US. There are a number of possible outcomes: A) The Fed and The Administration continue to pour on the gas. (QE-2 from Ben and a hefty $500b spending package AKA “the Krugman” option) B) We could go to December 1st when the fiscal commission confirms what we already know (we are about 4-5 years away from an explosion) and a credible plan is put forward to increase taxes and reduce expenses. C) We do essentially nothing on monetary or fiscal policy. If we get A it will surely be bad for the dollar across the board. It would imply that there would be a financial penalty for owning dollars; our deficit would rise to over 10% of GDP. Where’s the beef for owning the buck in that scenario? If we get B it will be in the form of, “We are going to tighten our belts, but not now. It would aggravate unemployment so we are going to get serious about our budget, but not until 2013.” Kiss of death for the dollar. Some form of C is most likely. We continue with ZIRP as we now know it (with minor tweakage). No major new fiscal approaches are undertaken. The benefits of the 09 ARRA stimulus will fade. Some taxes will be raised. Dividends, capital gains and incomes over $250,000 will be taxed at higher levels. On paper the deficits will look smaller as a result (6-7% at best). But this will kill the economy. In this scenario long-term growth will fall to sub 1%. As that happens the deficits will explode on their own. Who wants dollars if this happens? The FX markets rule the roost. Central banks can only watch and hope that things turn out as they wish. The Japanese and Swiss CBs tried to contain the fx market. They failed. In the midst of the EU chaos the ECB did not intervene. They knew their presence would just have attracted more sellers. It has been quite a few years now that the Fed has stuck its toes in the intervention waters. But that does not mean we should ignore what the CBs and Treasury types are signaling. I see evidence that the major European countries are moving in a direction that would be friendly to their currencies. The US is going down a decidedly different path. According to the WSJ’s Jon Hilsenrath, QE-2 (Lite) will be announced next week. He gets his thoughts straight from Ben B., so the cards are being dealt. Bernanke has a Bloomberg. He knows exactly where the EURDLR is trading. He is whooping for joy today. He wants a weak dollar more than anyone in the world. He is praying for inflation at this point. A weaker dollar is very helpful in achieving that. So when you weigh the sides of this, and if you’re looking to place a bet, always keep in mind that there is no one who has a hand on the levers that wants a strong dollar. They all want it weak. We are seeing this play out already. Look at crude. Why is it breaking out? I think the dollar is driving it. I ask the question, What possible benefit could this bring to the US economy? Inventory profits for big oil is a good plan? Lining the pockets of those we import oil from helps America? But it will make inflation go up, and headline inflation is what the Fed wants to see. We’ll just be poorer as a result. The line “All 96 cent currencies go to par” was a reference to the Swiss Franc. It is currently worth 96.25 cents (1.0389). In my many years of watching this silliness I have observed that most things that get to 96 do go to 100. We shall see. |

Leave a Comment